Why TKO Group Stock Hit a Record High Today

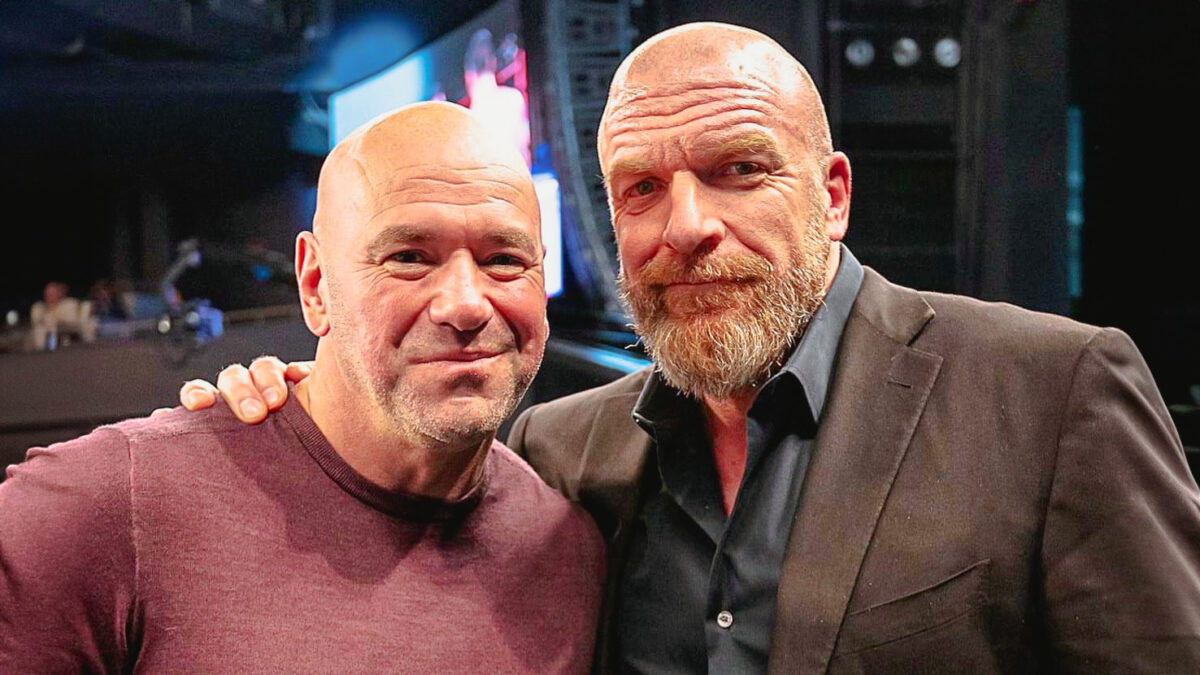

TKO Group Holdings (NYSE: TKO), the parent company of WWE and UFC, hit a new all-time high of $153.89 in trading today, driven by a combination of strong insider activity, strategic growth prospects, and bullish analyst outlooks.

Price Target Upgrades

Several prominent analysts raised their price targets for TKO stock:

- Guggenheim increased its target from $142 to $170, reaffirming a “Buy” rating.

- Canaccord Genuity also raised its target, citing positive financial trends and strong company performance.

Insider Buying Activity

The stock’s surge was partly fueled by significant insider purchases. Major shareholders acquired $50.3 million worth of TKO stock, signaling confidence in the company’s growth trajectory.

Strategic Growth Drivers

Market optimism is further supported by several key factors:

- Media Rights Renewals: Analysts expect the renewal of UFC and WWE Pay-Per-View deals with Peacock to deliver substantial value, with UFC rights potentially doubling in value.

- Operational Synergies: The merger between WWE and UFC has yielded over $100 million in cost savings, with projected revenue synergies exceeding $250 million.

- Sports Rights Market: A competitive landscape for sports broadcasting rights has generated significant interest in UFC, enhancing TKO’s market positioning.

These factors collectively demonstrate TKO’s ability to capitalize on strong industry trends and operational efficiencies, bolstering investor confidence and driving today’s record stock performance.