Overview of WWE Q2 Report: Network Subs Up, TV Ratings Declining As Rights Fee Buoy Business

WWE continues to be at the center of an evolving media environment. Its recent brand extension is attempting to repair falling television ratings while rights contracts with broadcast partners continue to pay the wrestling company escalating fees into 2019. While the guaranteed money rolls in, WWE is still busy building up its live streaming service and widening its social media footprint.

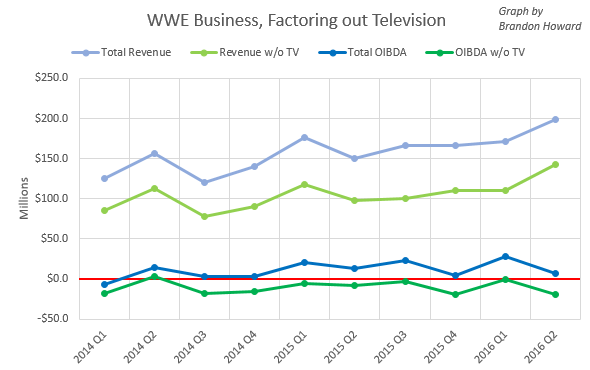

Vince McMahon’s business may have gone all-in on the Network too soon in 2014, however, according to WWE’s Q2 report released today, OIBDA (a metric similar to profit) through the first six months of 2016 is about the same as it was at this time in 2015. The company estimates OIBDA for the year will be between $80 and $85 million, which would be a significant increase over $61.6 million for 2015.

TV rights could be the ship that sails WWE to whatever new media world it arrives at in mid-2018, when the next all-important TV contract negotiations likely take place. TV revenue will almost certainly be the largest source of money for the company at least until then. That segment of business accounted for $56.1 million in Q2 (April 1 to June 30), or 28% of all revenue.

TV money alone, in almost every quarter since 2014 is the difference that makes WWE a profitable business. The state of the media landscape in 2018, which is for now too hard to predict, and whether the company can negotiate another set of favorable rights deals with its major TV partners in the United States, United Kingdom and India, will have major implications for the future of the company’s business, and ultimately the future of the industry.

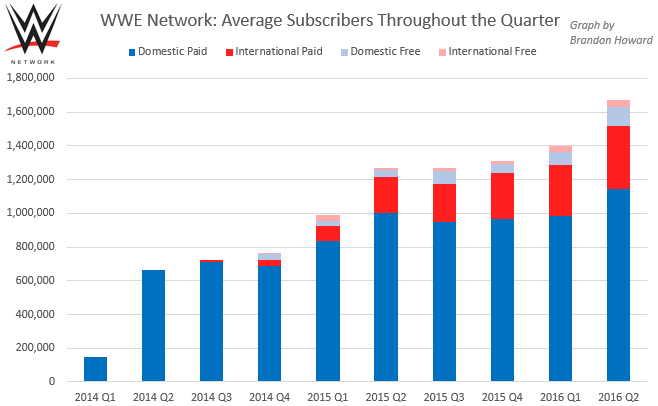

Paid subscriptions to the WWE Network continued to rise quarter-over-quarter. The “Free WrestleMania” campaign allowed new users to sign up for a free trial subscription that would allow them watch WrestleMania for free and potentially cancel their subscription without ever making a payment.

Paid subscriptions on the last day of the quarter, June 30 (1,511,000), managed to be slightly higher than the count on the day after WrestleMania 32 (1,454,000). WWE estimated average paid subscriptions will be within 2% of 1.49 million for next quarter, slightly down from 1.52 million this quarter.

The Network itself, however, had its first money-losing quarter since Q1 2015, due to investment in all the new programming intended to entice subscribers to keep their subscriptions after WrestleMania.

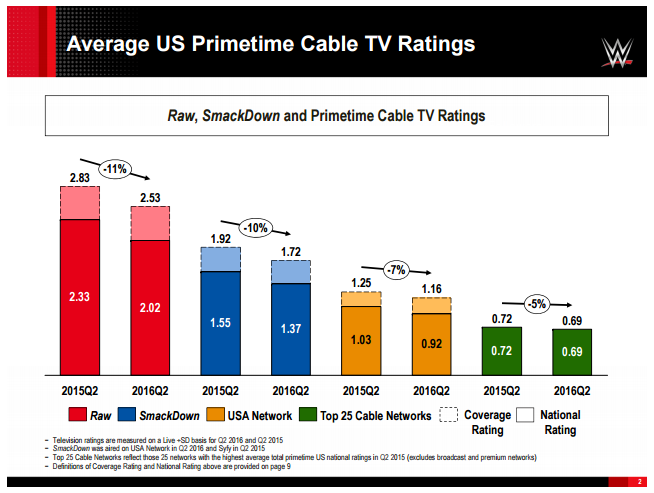

Meanwhile ratings have continued to decline at a concerning rate. WWE made that fact clear to investors on the very first page of their Key Performance Indicators document. The company makes it evident its ratings are falling harder than the rest of cable TV’s primetime programming, including its own home, the USA Network.

Ratings remain important to WWE’s relationships with its TV partners, who provide the company’s largest revenue stream. Even with declining TV ratings, though, research I’ve done recently shows that other metrics like live event attendance, merchandise revenue and Google searches, don’t support the conclusion that WWE’s popularity is also declining.

Strangely, WWE stated in its investor presentation and CEO Vince McMahon reiterated on the conference call that the July 19 rating for SmackDown was the highest since the program’s move to cable. SmackDown moved from MyNetworkTV (broadcast) to Syfy (cable) on October 1, 2010. According to PWTorch.com, the July 19, 2016, episode did a 2.20 rating. According to records on Gerweck.net, there are actually nine instances, both live specials and taped shows, when SmackDown did an equal or better rating than it did on July 19 of this year:

- 12/21/2010: 2.53 (live airing)

- 2/18/2011: 2.31 (taped)

- 10/7/2011: 2.26 (taped)

- 10/14/2011: 2.21 (taped)

- 10/28/2011: 2.22 (taped)

- 12/2/2011: 2.24 (live)

- 1/13/2012: 2.21 (taped)

- 12/18/2012: 2.29 (live)

- 1/11/2013: 2.20 (taped)

We contacted WWE to ask whether its claim was an oversight, but have yet to receive a response.

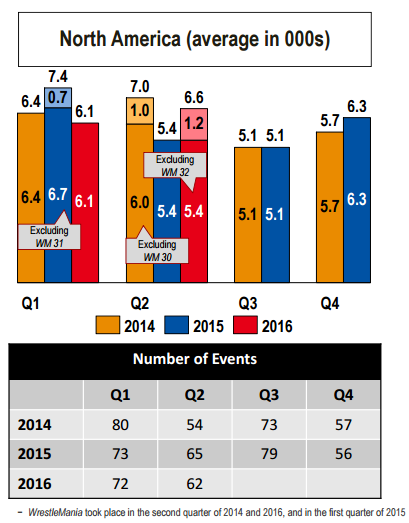

Subject of some mild controversy, we now have an idea of what the actual paid attendance was for WrestleMania 32. Based on information published in the Key Performance Indicators, the paid attendance was somewhere between 73,711 and 85,888. (The spreadsheet used to calculate this is here.) Because the numbers above are rounded numbers, we only know the WrestleMania paid attendance within that range. WWE claimed as recently as in its press release today that 101,763 fans were in AT&T Stadium for the event. Dave Meltzer of the Wrestling Observer Newsletter reported the attendance was actually 97,769. It’s still possible thousands of fans were in the stadium with free admission, bringing the number closer to either WWE or the Observer’s report. But based on WWE’s own reports, we now know no more than 85,888 fans paid for admission to the event, and probably closer to something like 80,000 did.

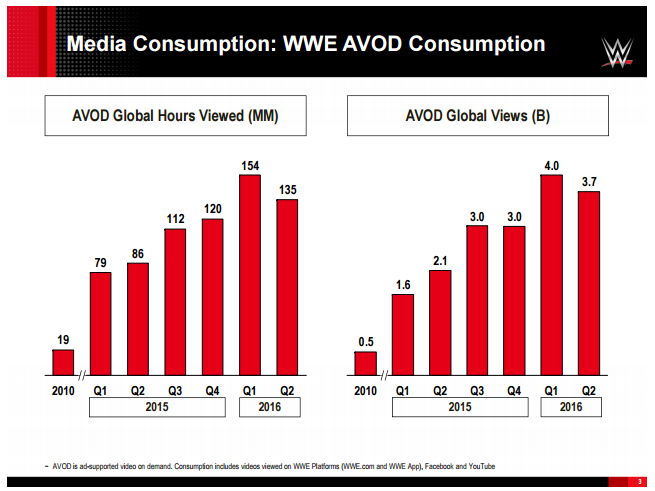

After many quarters of explosive growth, we got the first clue that video views on platforms like YouTube may have finally reached maturity for WWE. The peak in views and hours viewed in Q1 and the slight decline in Q2 could be related to increase interest leading up to WrestleMania, though, so this will be an interesting page in the KPIs to watch in Q3. If these two metrics stay flat or decline more, then that gives us good evidence that online video has reach its potential.

For the billions of video views WWE gets each quarter, they doesn’t translate into much OIBDA. The Digital Media segment, which accounts for revenue from ad-supported videos on YouTube and the like, made $6.5 million in revenue in Q2 and only $200,000 in OIBDA. Last quarter it lost $100,000.

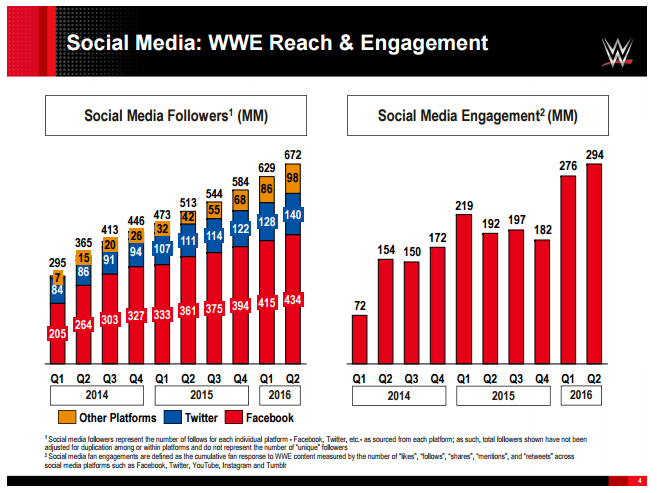

However social media engagement is still trending upward. While social media followers is a metric that will always increase, social media engagement (a measure of “likes”, “follows”, “shares”, “retweets”, etc.) does fluctuate and is still on the rise more often than not for the company. Even less so than YouTube views, social media engagements don’t directly generate much if any revenue. If they achieve a more “steady state” though, they could eventually give us an idea of WWE’s overall popularity, should the company choose to continue to report these metrics.

WWE Chief Strategy and Financial Officer George Barrios went out of his way on the conference call to stress: “Changes in foreign exchange rates did not have a material impact on either revenue or profit for the quarter.”

Barrios was likely alluding to the so-called Brexit referrendum in the U.K. that took place on June 23, which led to a decline in the exchange rate of the British pound. The quarter, however, ended on June 30, so there was only seven days in this quarter in which the decline in the value of the pound could have affected WWE’s business. Chris Harrington of WrestlingInc.com confirmed with WWE that its U.K. TV rights fees are paid in U.S. dollars, not pounds. However, it’s possible going forward that WWE’s business in the U.K. could be affected, as products sold directly to those consumers, such as WWE Network subscriptions, live event tickets and merchandise are charged in pounds. The British pound to U.S. dollar exchange rate has is down about 10% since the Brexit vote.

Investors must’ve been unsurprised by any news learned today. WWE’s stock was barely affected by the earnings release, holding in the $19 per share range all day.

To that point, this was a pretty lukewarm quarterly report for WWE. The company has clearly become very good at using its analytics to make estimates about what to expect for Network subscriber numbers. It’ll be interesting to see if it can go so far as to make an accurate estimate next year before WrestleMania. Thanks to accurate Network subscription estimates and guaranteed TV rights fees, the company can provide reliable estimates on OIBDA to its investors as well. There are fewer surprises now for WWE’s business, after a more volatile 2014 and 2015. As noted, that volatility may return when major television contracts come closer to their ends and need to be renegotiated, around 2018.